- Iranians moved significant funds from domestic exchanges to personal Bitcoin wallets during late 2025 as a flight to safety before a nationwide internet blackout.

- Total crypto activity hit 7.78 billion dollars in 2025 as citizens sought alternatives to a domestic currency that has lost 90 percent of its value since 2018.

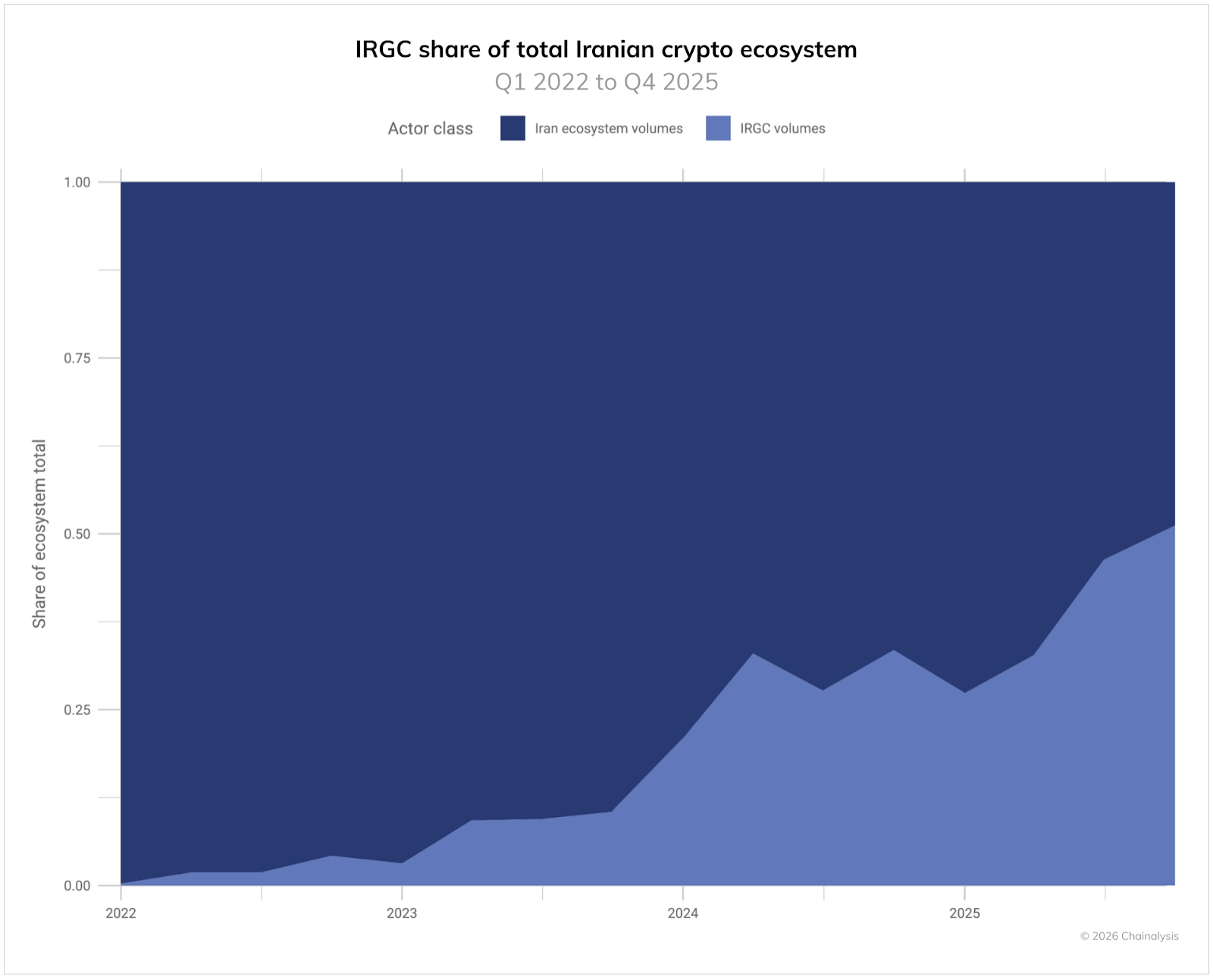

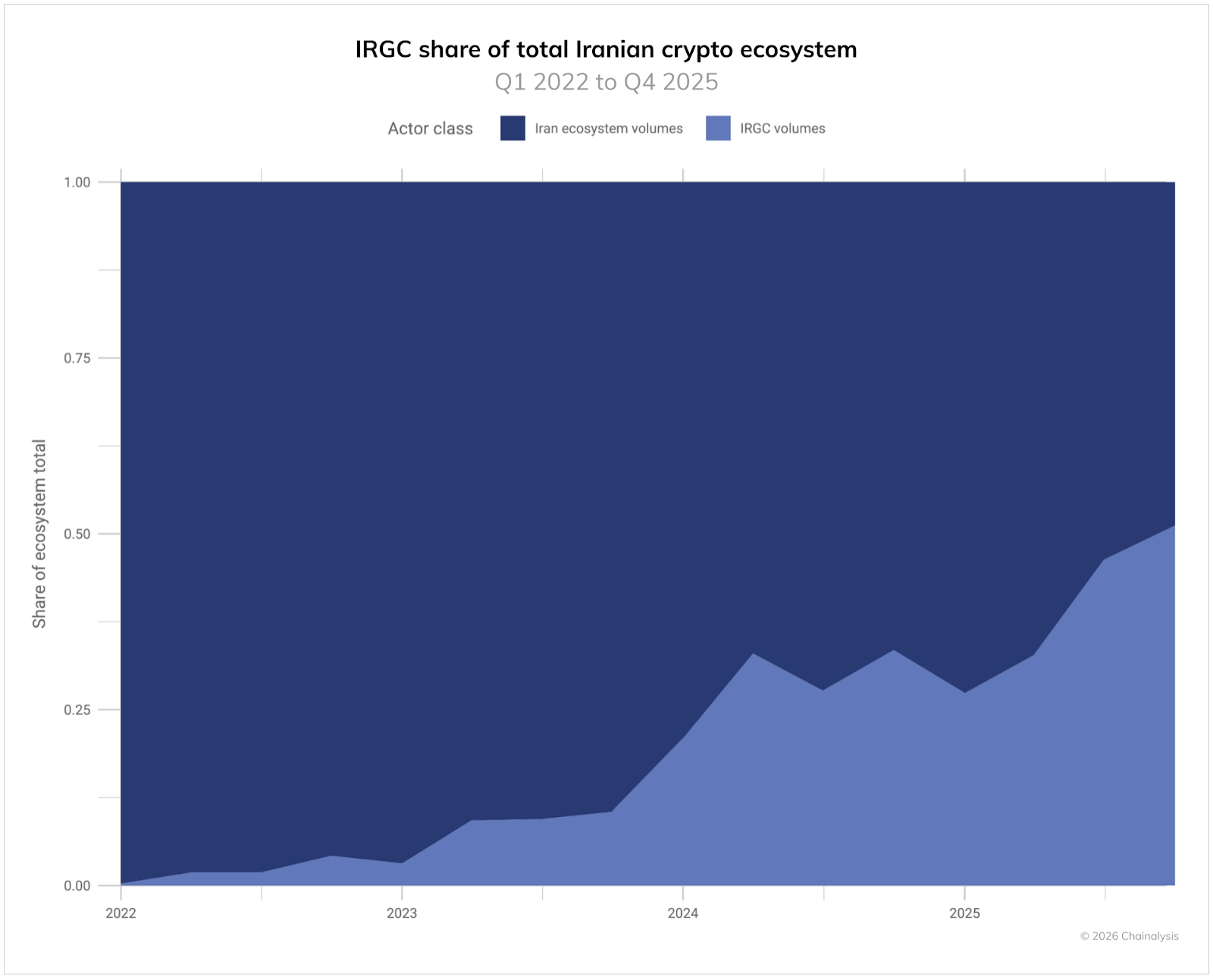

- Wallets linked to the Revolutionary Guard received over 3 billion dollars in 2025 and accounted for more than half of all transaction value in the final quarter.

Crypto transactions linked to Iran rose sharply during late-2025 protests, with blockchain data showing a surge in withdrawals from Iranian exchanges into personal Bitcoin wallets between December 28, 2025, and January 8, 2026, the period leading up to a nationwide internet blackout.

According to a report from Chainalysis, both the average daily transaction value and daily transfers to self-custodied wallets increased compared with the period from November 1 to December 27, 2025.

The report put Iran’s total crypto activity at a massive US$7.78 billion (AU$11.6 billion) in 2025, growing faster than the year before.

Read more: Analysts Say Stress-Testing Gold vs. Bitcoin Reveals a Clear Winner

Crypto as an Alternative to the Rial

Crypto has become a financial alternative as the rial has fallen about 90% since 2018 and inflation has run at roughly 40% to 50%, according to the report, pushing more households to seek assets that can be held outside the domestic banking system.

It also found a rising share of flows tied to wallets associated with the Islamic Revolutionary Guard Corps (IRGC). IRGC-linked addresses accounted for more than 50% of total value received in Q4 2025.

Moreover, the report estimated IRGC-associated wallets received more than US$2 billion (AU$2.9 billion) in 2024 and more than US$3 billion (AU$4.3 billion) in 2025, based on a set of addresses identified through sanctions designations by the US Treasury’s Office of Foreign Assets Control (OFAC) and Israel’s National Bureau for Counter Terror Financing (NBCTF).

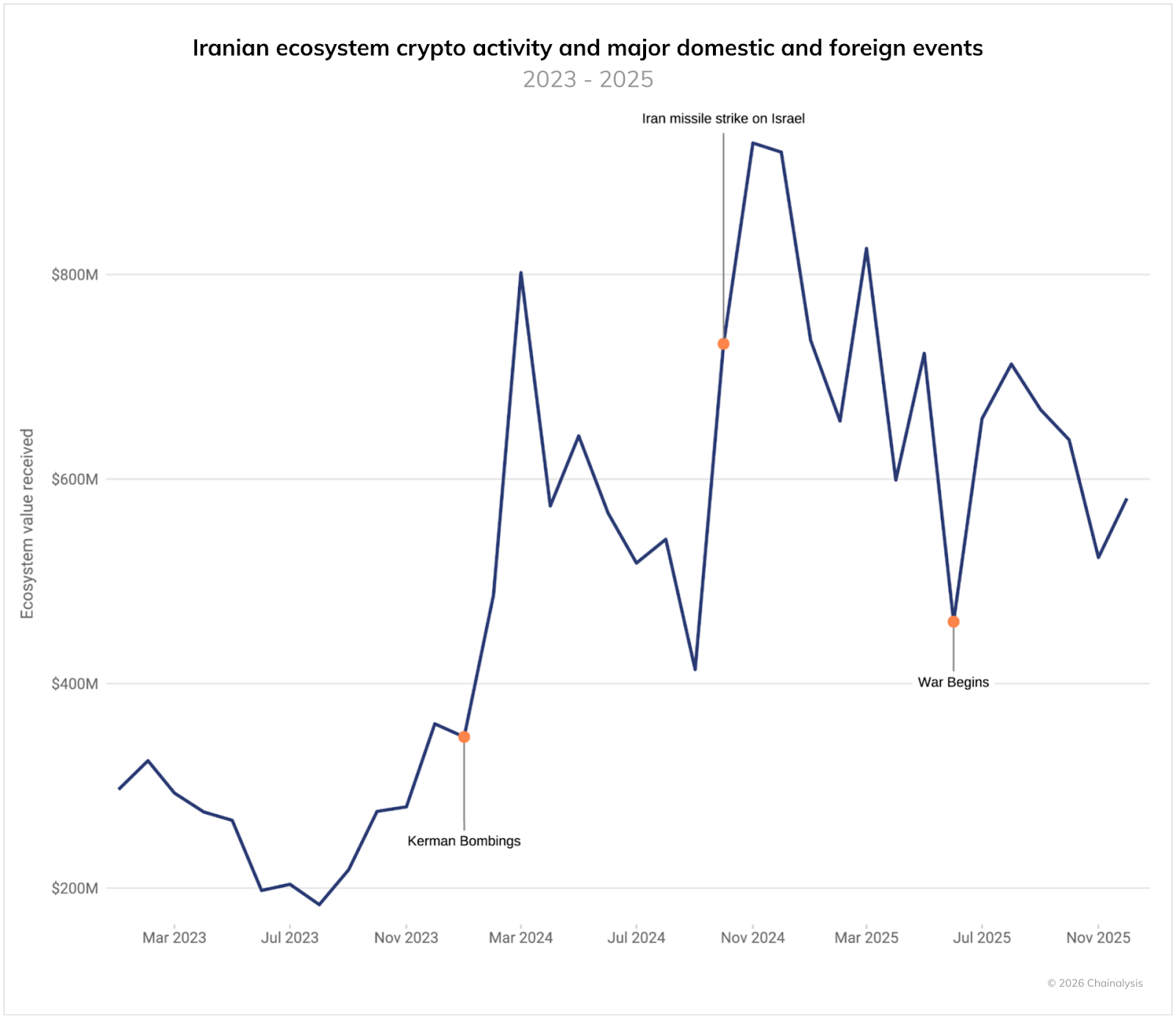

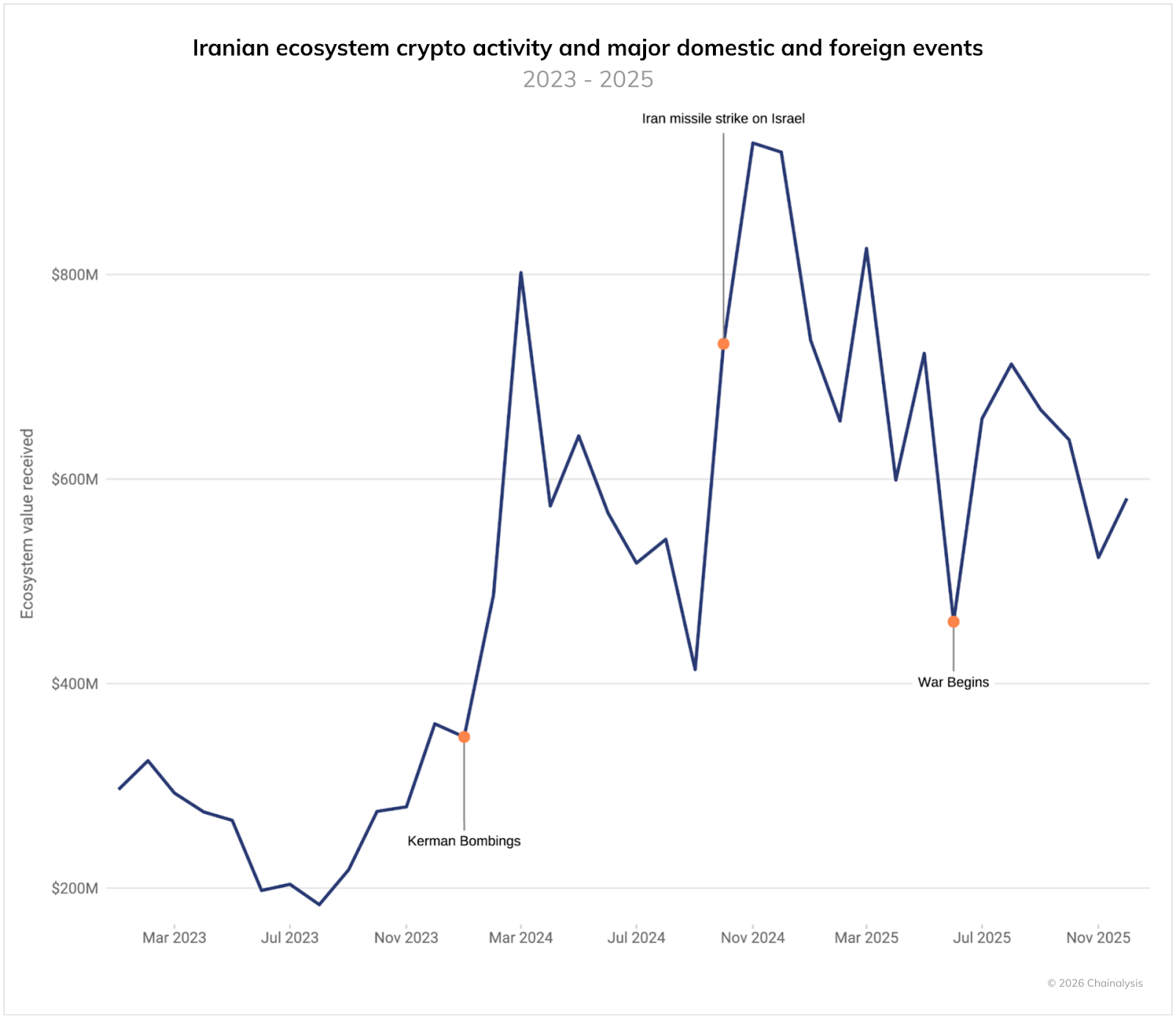

The same dataset showed spikes in Iranian crypto activity around major security and geopolitical events, including the Kerman bombings in January 2024, Iran’s missile strikes on Israel in October 2024, and a 12-day war in June 2025. The report linked the June 2025 spike to cyberattacks on Nobitex, Iran’s largest crypto exchange, and Bank Sepah, an Iranian bank described as heavily used by the IRGC, as well as a breach of Iranian state TV.

The analysis said its IRGC figures are a lower-bound estimate because they rely on a limited set of publicly identified wallets and do not include potential shell entities or unidentified addresses.

Many other countries around the world, usually struggling with sanctions and a deteriorating economy, often flock to cryptocurrencies in order to save some purchasing power as inflation takes a toll on their respective currencies.

One case is Venezuela: from July 2024 to June 2025, Venezuela ranked fourth in Latin America by crypto value received, mostly through Binance.

Related: From Mania to Infrastructure: Crypto’s 2026 Setup

Bitcoin,Cryptocurrency,Iran#Irans #Crypto #Surge #Reflects #Economic #Flightand #Sanctions #Pressure1768566933