- Bitcoin showed modest stabilisation in early 2026, rising over 3% in the first trading sessions whilst equity markets weakened.

- December weakness stemmed from year-end market mechanics—thin liquidity, tax-loss selling, and portfolio rebalancing rather than crypto-specific shocks.

- Bitfinex notes that slowing ETF-related selling into year-end suggests significant de-risking has already occurred, potentially improving liquidity conditions ahead.

Bitcoin (BTC) opened 2026 showing signs of stabilising after a weak, illiquid finish to 2025.

According to a report from Bitfinex Alpha, early 2026 trading has shown a modest change in the mix. Bitcoin was up more than 3% in the first sessions of the year while equities softened, a shift that traders are watching for signs the short-term divergence could narrow.

What Really Caused Bitcoin’s December Weakness

Bitfinex’s note argues that Bitcoin’s late-December weakness was less about a fresh crypto-specific shock and more about year-end market mechanics. Trading liquidity thinned, volatility dropped, and BTC moved sideways in a relatively tight band.

Moreover, the report attributes the soft tone to tax-loss selling and portfolio rebalancing as investors closed out the year, especially since equities finished 2025 strongly while crypto lagged.

Read more: Judge Tosses Voyager Investors’ Lawsuit Against Mark Cuban Over Mavericks Crypto Deal

They then point to early 2026 as a small, tentative improvement: Bitcoin rose in the first sessions of the year while stocks eased. Bitfinex treats this as a possible short-term shift, not a confirmed trend. The key indicator they focus on is ETF flow behavior.

They say the pace of ETF-related selling slowed into year-end, which could mean a lot of the de-risking has already happened. If liquidity improves as January progresses, the next ETF flow prints will help show whether new institutional buying is returning or whether investors remain cautious.

Finally, they add context that adoption and positioning are still expanding, even if the price is choppy. They cite continued corporate treasury accumulation. An example of this is Strategy, adding a lot of Bitcoin, even though they reported a US$17.4 billion (AU$25.8 billion) unrealised loss and BitMine building a large Ethereum (ETH) position and moving into staking/validator infrastructure, as Crypto News Australia reported.

What About The Macro Side?

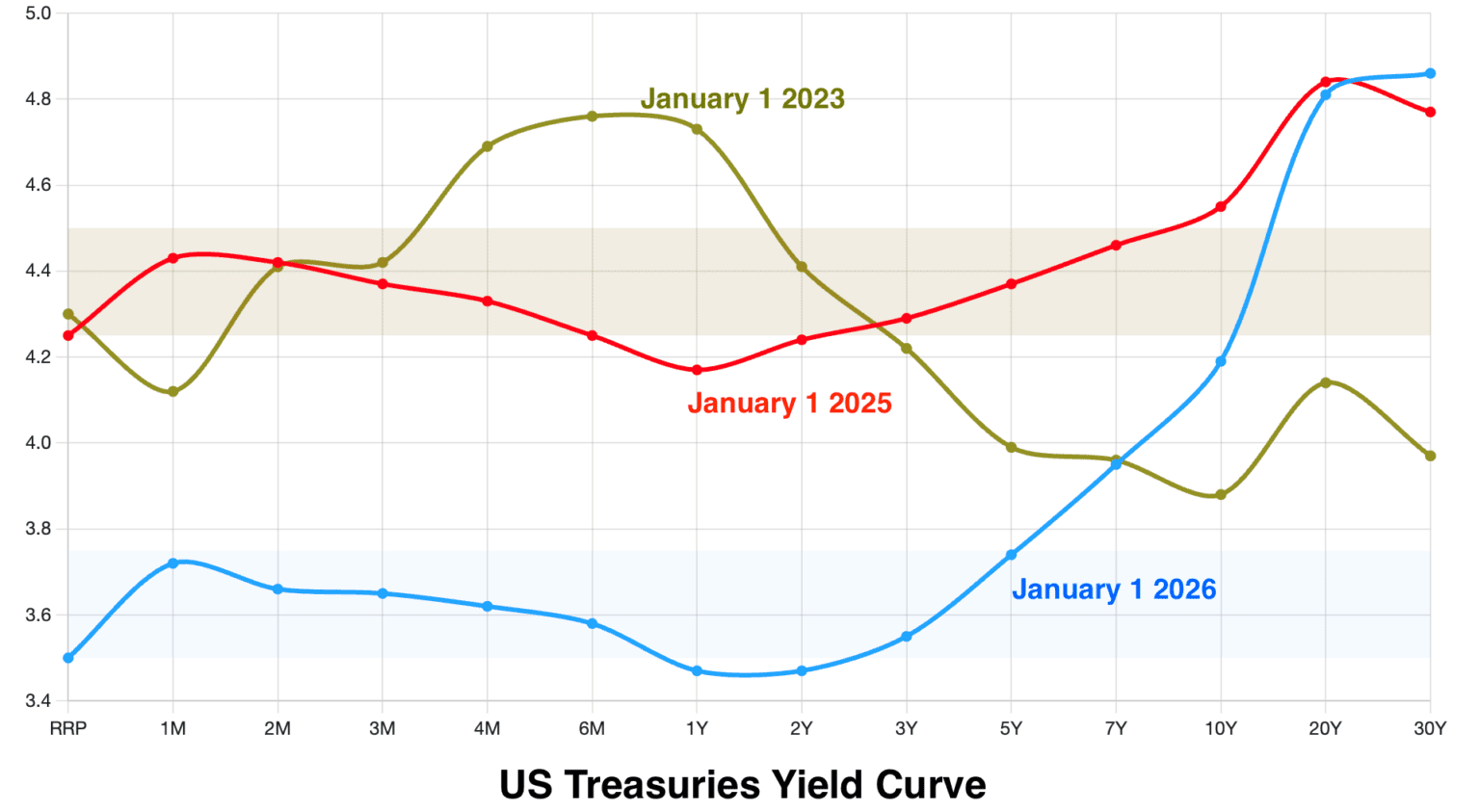

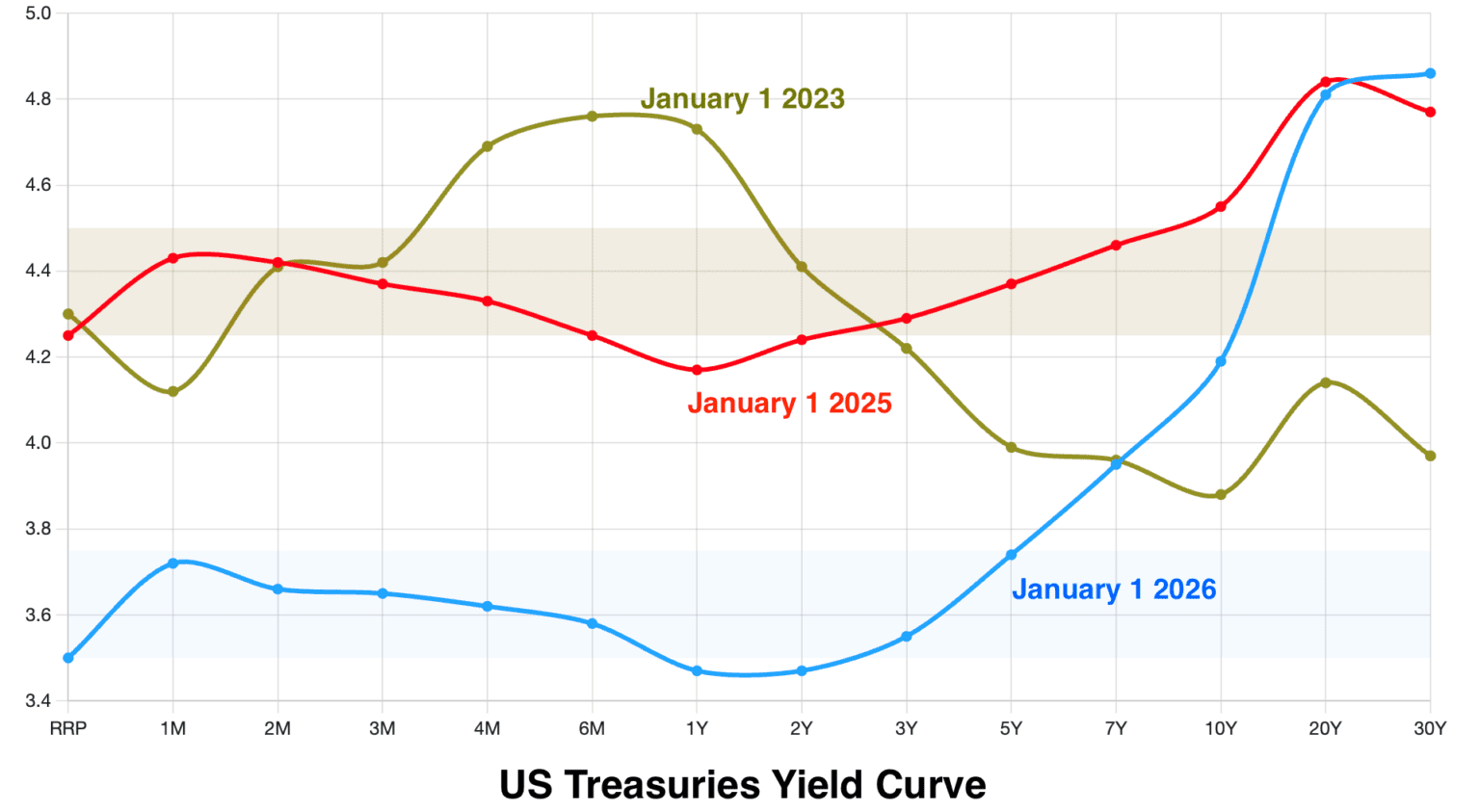

Well, Bitfinex frames the environment as supportive in some ways but still restrictive overall. They highlight a steepening US yield curve, short-term yields expected to fall later with easing, while long-term yields stay elevated because of inflation uncertainty, heavy government issuance, and fiscal concerns.

They also note a weaker US dollar year-to-date. Put together, their message is that liquidity may improve, but not evenly across markets, so broad “risk-on” rallies may be harder than in looser conditions.

Anyway, the takeaway is that, yes, price is stabilising, potential selling pressure may be fading, but macro conditions and flow data will determine whether that stabilisation turns into a durable move.

Read more: XRP Breaks $2 as ETF Inflows Fuel Early-2026 Rally

Bitcoin,Bitfinex,ETF#Analysts #Bitcoin #Finds #Footing #Opens #Eyes #Turn #ETF #Flows1767676923