2026 is emerging as a defining milestone for global finance. President Trump already signed the Genius Act on July 18, 2025, establishing consumer protection, monthly transparency, compliance, redemption rights, and full reserve backing for tokenised dollars – stablecoins.

Although temporarily postponed, the CLARITY Act is to further modernize finance by allowing stable yield programs, now contested by banks for purportedly giving crypto exchanges unfair advantage. Facing staunch opposition from TradFi, the upcoming draft lacks ‘clarity’ in many areas, as noted by Brian Armstrong, CEO of Coinbase.

Nonetheless, both acts, in some form or another, signal an unmistakable shift in regulatory posture. Stablecoins are no longer treated as a peripheral crypto innovation but as a core component of the future financial system.

The question is, what is to become of the crypto market with a stablecoin surge at hand? First, let’s examine what stablecoins have already become.

Stablecoins: Digital Export for the US Treasury

During the pandemic narrative, the technocrat push for digital IDs (via COVID certificates) and “build back better” mania, it seemed almost a certainty that a Central Bank Digital Currency (CBDC) would become a reality. Yet, only the EU, as the West’s major economic zone, is actively pursuing it.

In early September, Institute for European Policymaking at Bocconi University noted that the European Central Bank (ECB) “must step up” if President Trump weakens the Federal Reserve. Furthermore, on January 13, 2026, the ECB released a statement from Christine Lagarde that central bankers “stand in full solidarity” with the Federal Reserve System.

These sentiments imply that the ECB is subservient to the Fed. Of course, this could also be extrapolated from the very fact of dollar hegemony. Specifically, if the Fed chooses a “hawkish” mode, while the ECB is in the “dovish” mode, the Euro weakens. This makes energy and imports costlier, ultimately driving up inflation.

Likewise, the ECB relies on permanent swap lines by the Fed to provide dollar liquidity to European banks. In other words, the ECB’s purported independence is reliant on the Fed’s policymaking.

With that in mind, it is easier to understand why the Fed abandoned the CBDC project, unlike the ECB. After all, a CBDC would add little to Washington’s strategic position while introducing substantial political risk. On the domestic front, it would also collide head-on with American sensitivities around surveillance and financial privacy.

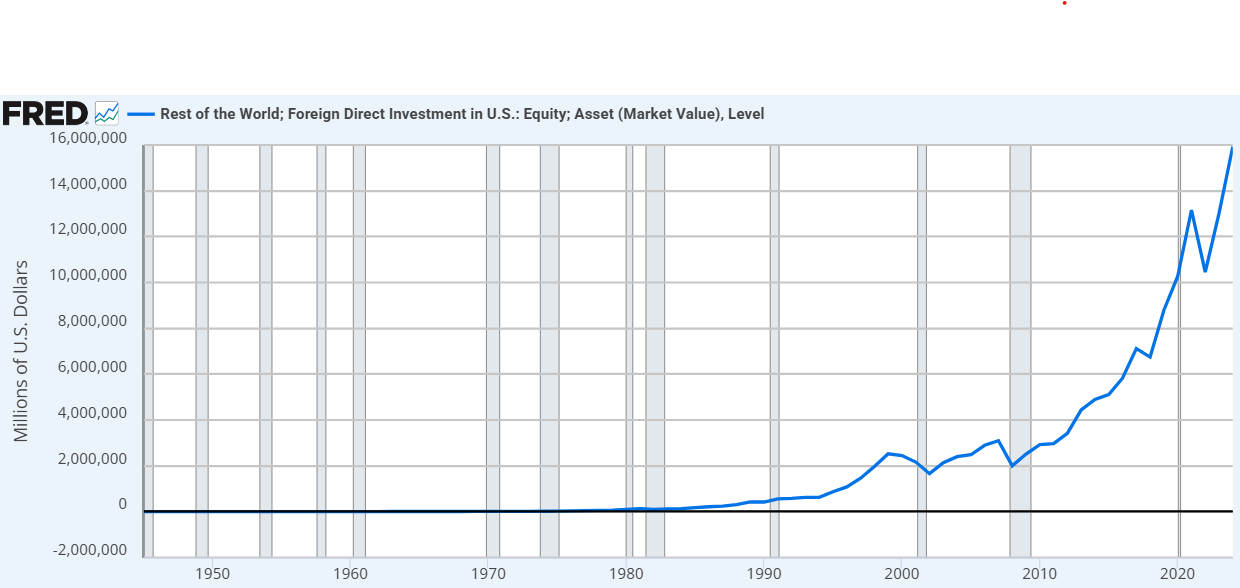

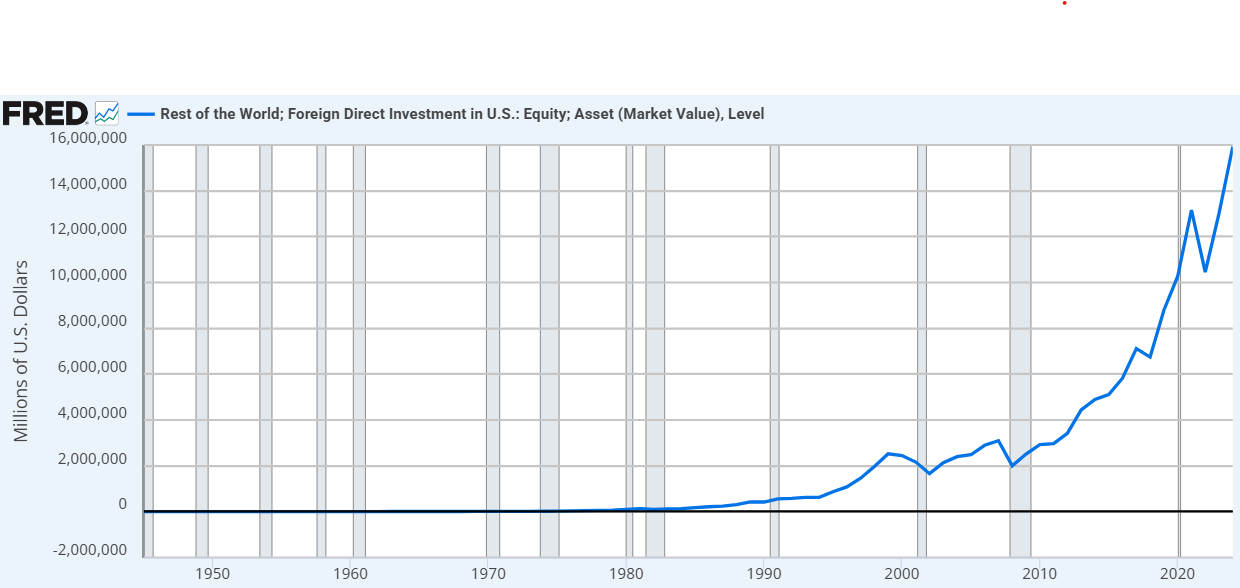

In this light, stablecoins are effectively privatized CBDCs that circulate globally, such as on Ethereum, Solana or Tron. Tether alone, issuer of USDT, backed its $181.2 billion stablecoin with $112.4 billion worth of U.S. Treasury Bills, as of September 2025. For comparison, this single private company holds more T-bills than Germany’s holdings, while Japan still ranks first at $1.2 trillion in T-bills.

By contrast, the ECB’s CBDC push reveals Europe’s structural weakness. The digital euro is not a global export product and a way to project monetary power outward. The ECB openly admitted as much in November last year.

“Significant growth in stablecoins could cause retail deposit outflows, diminishing an important source of funding for banks and leaving them with more volatile funding overall.”

In fact, the ECB is concerned about stablecoin concentration and de-pegging events that could affect the U.S. Treasury markets, once again confirming its subservience.

Now that we’ve cleared up this important dynamic, what happens if stablecoins actually end up strengthening the US dollar? Will this be beneficial or detrimental for the crypto market?

But first, we need to revisit the Dollar Milkshake Theory.

The Dollar Milkshake Theory in a Nutshell

No matter how weak the U.S. is perceived, with various racial strife, mass welfare fraud, exorbitant budget deficits and degraded infrastructure, the dollar hegemony is still there to service global liquidity.

Accordingly, Brent Johnson proposed that the global economy is a giant milkshake of liquidity, with the US dollar as the straw. And in times of stress, capital doesn’t just leave markets but it is sucked into the US dollar as the world’s reserve currency, deeply entrenched into capital markets.

In the context of stablecoins, the Dollar Milkshake Theory is already boosted by the GENIUS Act, and likely with the upcoming CLARITY Act. Consequently, stablecoins like USDC and USDT would be the most efficient delivery system for US monetary policy ever invented.

To put it differently, stablecoins would replace the old, narrow paper straw with a high-speed digital turbine in the form of various blockchains, either institutional like the Canton Network or decentralized. Yet, this also implies that the dollar would strengthen as well. After all, the demand for U.S. Treasuries, serving as a reserve for stablecoins, typically strengthens the dollar by attracting foreign capital seeking safe and high-yielding U.S. assets.

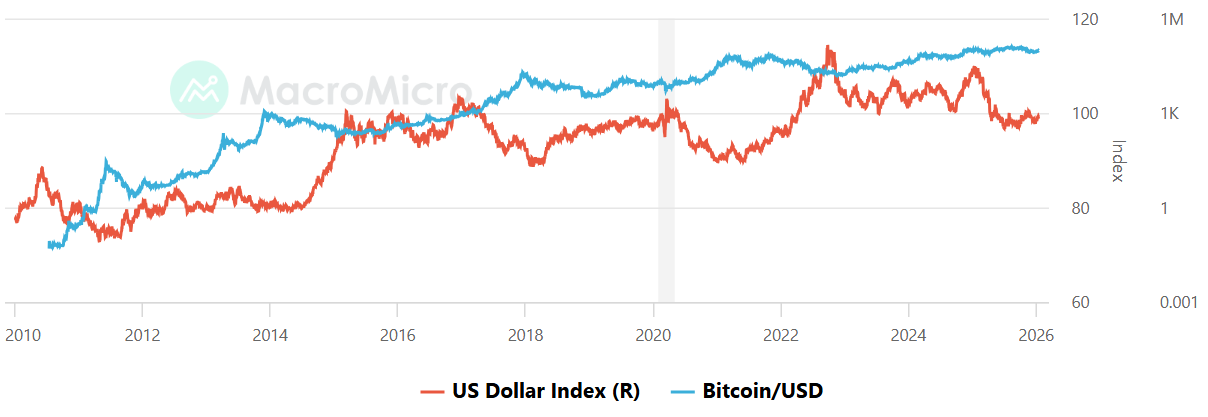

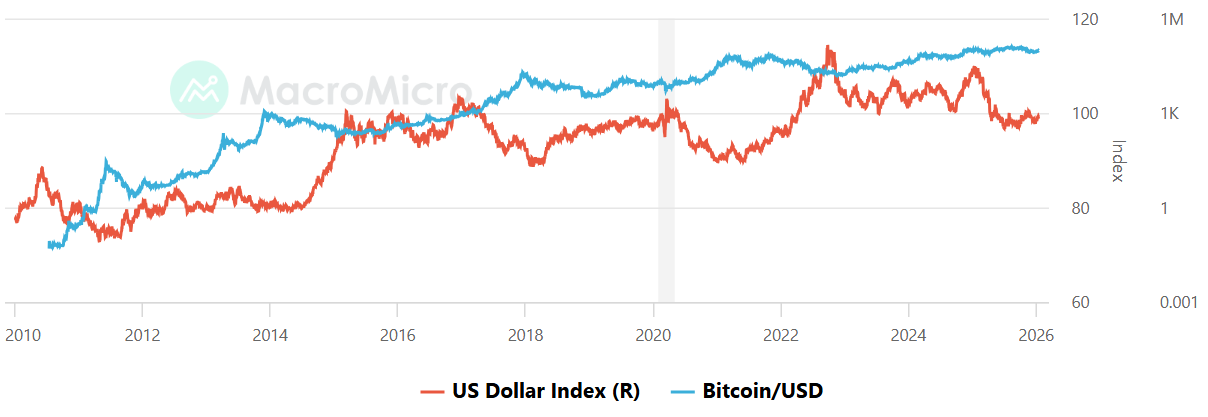

This correlation only broke down during President Trump’s global tariff realignment. Nonetheless, with tariff anxiety in the rearview mirror, it is expected that the dollar will strengthen. In that case, it is easy to become worried as the dollar strength index (DXY) typically has an inverse correlation with Bitcoin.

Therefore, a case could be made that the stablecoin surge would end up making crypto weaker, yet also stronger. Let’s examine both scenarios.

Stablecoin Surge: The Stronger Case

If stablecoins successfully strengthen the dollar, the crypto market could transition from a speculative niche into a systemically important global utility. This would be the case for multiple reasons.

The US government would have a vested interest in the survival of the blockchain rails the stablecoins run on. Throughout 2025, the Trump admin officials signaled such a stance of political shielding on numerous occasions. Compared to Gary Gensler’s reign of arbitrary terror, this was unthinkable just two years ago.

By acting as a digital dollar, stablecoins keep capital trapped within the crypto ecosystem. Instead of cashing out to a traditional bank, users move into USDT or USDC. Consequently, this means that capital is ready to rotate back into BTC, ETH or any number of infrastructure coins at a moment’s notice.

Of course, the CLARITY Act would have to be favorable enough to make that happen.

Lastly, if the dollar becomes the killer app via stablecoins, TradFi giants like BlackRock or JPMorgan would become major participants. BlackRock’s BUIDL fund already operates on multiple blockchains like Ethereum, Solana, Avalanche, Aptos, and BNB Chain, as well as L2 scaling solutions like Arbitrum, Optimism and Polygon.

In short, stablecoins could become a high-velocity on-ramp. Within the context of the milkshake, capital is not only sucked into digital dollars but it sits in crypto-native wallets.

Stablecoin Surge: The Weaker Case

If stablecoins end up strengthening the dollar, they could act as a Trojan Horse, in the sense they could replace the crypto ethos of decentralization with a digital version of TradFi.

In October 2025, 10 major banks embarked on an initiative to create blockchain-based assets pegged to G7 currencies.

“The objective of the initiative is to explore whether a new industry-wide offering could bring the benefits of digital assets and enhance competition across the market, while ensuring full compliance with regulatory requirements and best practice risk management.”

Moreover, if the dollar’s strength is the goal, the US government will demand the ability to freeze assets and enforce KYC on every wallet. To operate freely, companies like Tether are tied at the hip with USG, as evidenced by the multi-million dollar series of stablecoins freezes, likely tied to the special operation in Venezuela.

If this becomes the norm, the fundamental proposition of the crypto market weakens, as censorship resistance is gradually removed. More importantly, if the dollar becomes highly efficient, accessible 24/7 from a digital wallet and programmable via stablecoins and accompanied by smart contracts, the urgency for a non-sovereign currency like Bitcoin may diminish – echoing older debates such as dividend irrelevance theory, where the structure of returns matters less than the underlying system that generates them.

After all, the global user may pick a convenient way to pay for goods, instead of looking for a long-term hedge. Lastly, by linking crypto directly to the US Treasury market, a contagion bridge may be erected. That is to say, if there is a crisis in the US bond market, this stress could rapidly transmit to a liquidity crisis in crypto, potentially causing a market-wide fire sale that decentralized assets cannot structurally prevent.

This would depend on redemption mechanics, market structure and leverage.

On the Australian Stablecoin Front

During 2025, Australia crossed multiple milestones. Most notably, the Australian Securities and Investments Commission (ASIC) updated its guidance on digital assets in October 2025. This was further clarification of how financing laws apply to stablecoins, granting temporary relief for distributors until June 2026.

In December 2025, ASIC also issued new exemptions for intermediaries handling eligible stablecoins and wrapped tokens, with another exemption from certain licensing requirements. In the meantime, after National Australia Bank (NAB) shuttered its AUDN stablecoin project, ANZ took the stablecoins reins with A$DC.

Most recently, Zodia Custody, previously invested in by NAB Ventures, expanded its digital asset portfolio to AUDM – the Australian stablecoin issued by Macropod.

AUDM is highly regulated, owing to the Australian Financial Services Licence (AFSL), which makes it the first institutional-grade stablecoin in the Australian market. As such, AUDM is backed 1:1 with physical AUD held in four major Australian banks – the “Big 4”.

However, holding AUDM is still not covered by the government’s Financial Claims Scheme (deposit insurance). Likewise, it doesn’t pay interest or yield but serves primarily as a payment and settlement tool. Depending on the finalized CLARITY Act, this would make AUDM an inferior digital product.

Australia,Stablecoins#Stablecoin #Surge #Threat #Boon1769574042